Call option profit formula

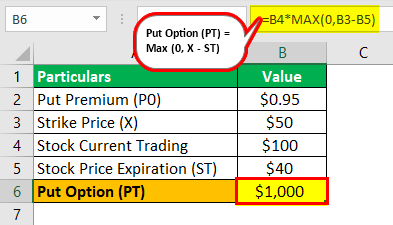

Solution Value of call option on HP stock max 0 242 22 22 Total value of DELL call options 5000 22. Calculating Call And Put Option.

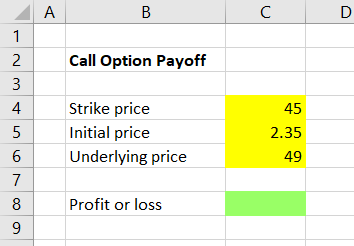

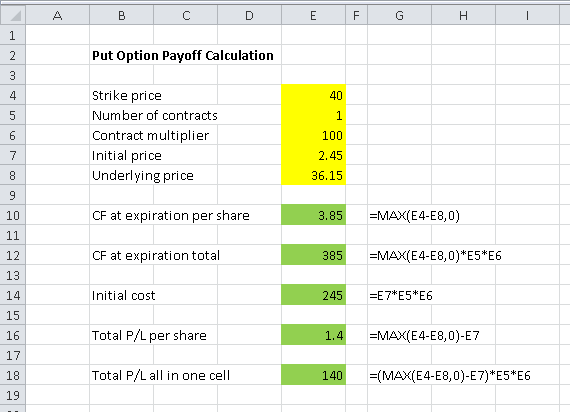

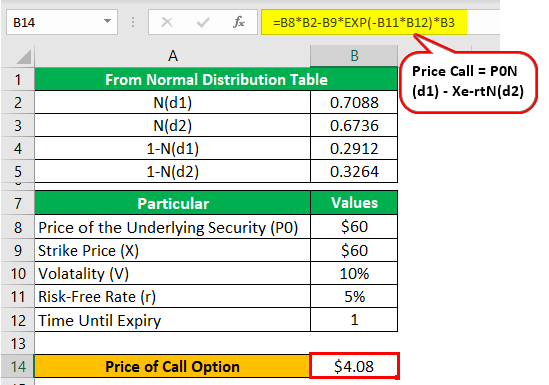

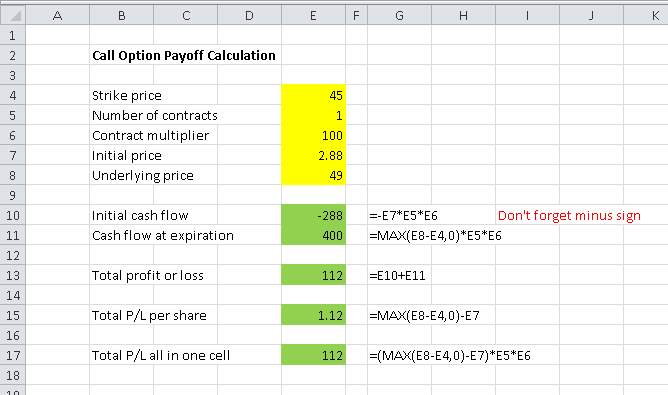

Calculating Call And Put Option Payoff In Excel Macroption

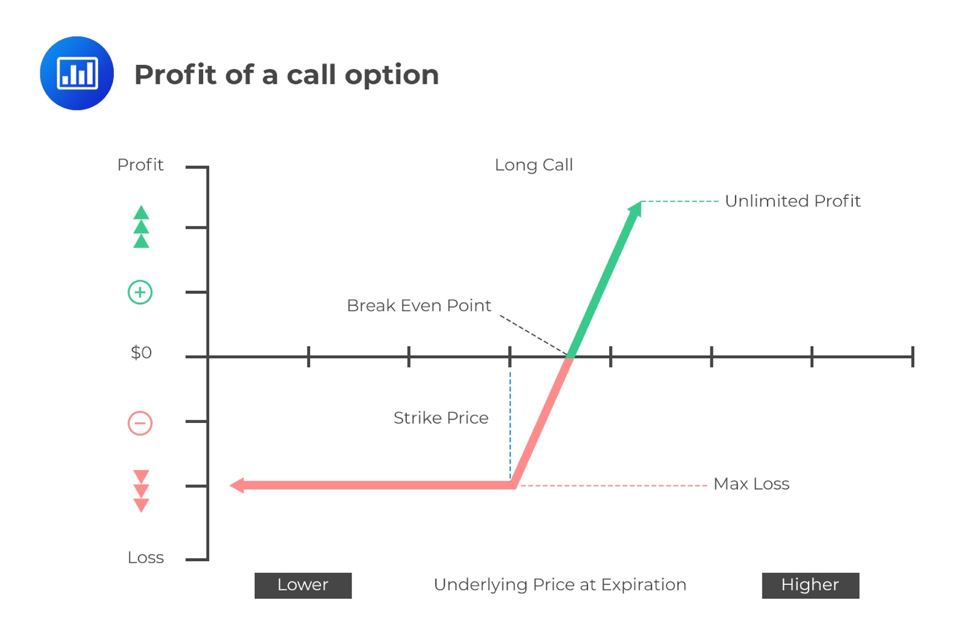

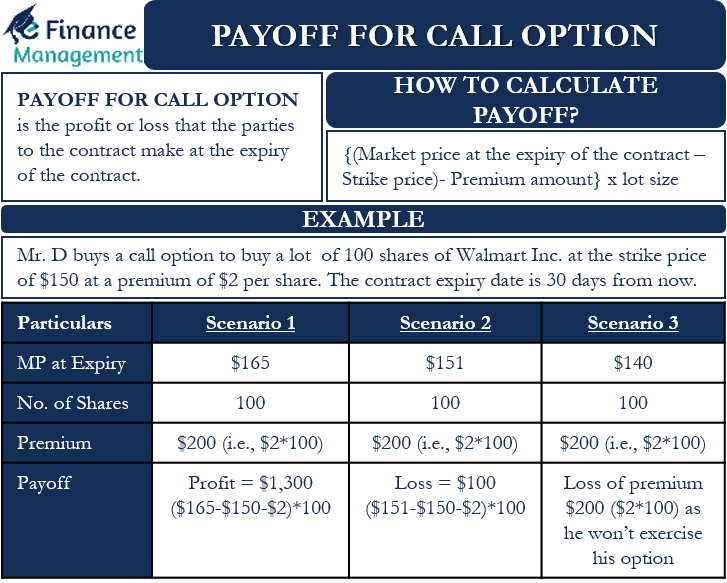

An call options Value at expiry is the amount the underlying stock price exceeds the strike price.

. The Profit at expiry is the value less the premium initially paid for the option. Profit 8 x 100 x 3 contracts 2400 minus premium paid of 900 1500 1667 return 1500 900. Purchase of three 95 call option contracts.

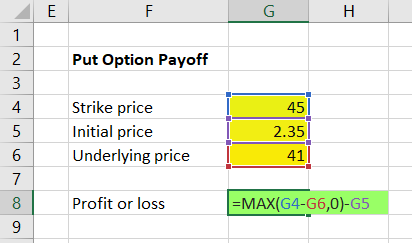

P Profit K Strike price S Stock price c Call price If the underlying assets price is lower than or equal to the strike price at the expiration date the holder does not. The long call calculator will show you whether or not your options are at the. Profit Strike Price Underlying Price Initial Option Price x number of contracts Using the previous data points lets say that the underlying price at expiration is 50.

Steps for solving the value of a call option with the single period binomial model. The same formula is applied for put options. However if the premium is 6 then you lose.

Breakeven BE strike price option premium 145 350 14850 assuming held to expiration The maximum gain for long calls is theoretically unlimited regardless of the option. To convert this figure into a percentage value reflective of total return divide the profit by the total purchase price of the asset and then multiply the resulting figure by 100. Calculate u and d.

To calculate the profit on a call option take the ending price of the stock less the breakeven price of the long call and multiply the result by 100. The breakeven price is equal to. To calculate the profit on a call option take the ending price of the stock less the breakeven price of the long call and multiply the result by 100.

Call Option Calculator Call Option Calculator is used to calculating the total profit or loss for your call options. Return on Call Option Formula. So if the current asset price is 47 and the strike price is set at 43 the option looks profitable indeed.

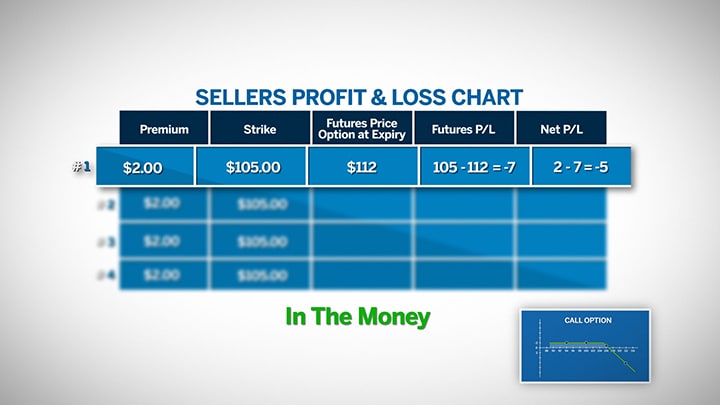

Of course the risk with. R The risk free rate. Scenario 4 - Seller Makes a Large Profit Selling a Covered Call Option The price of the underlying asset increases to 130 per share.

Calculate net profit if any on both call option trades.

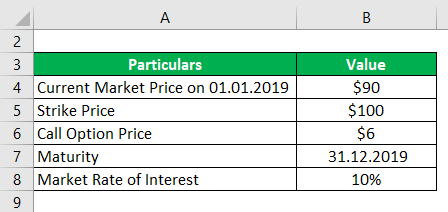

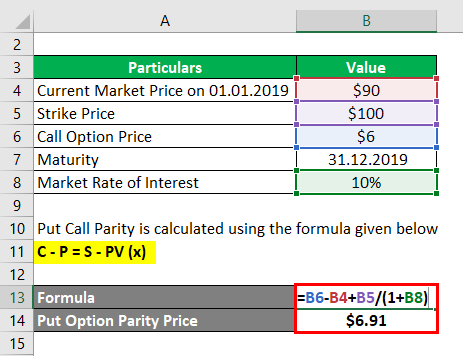

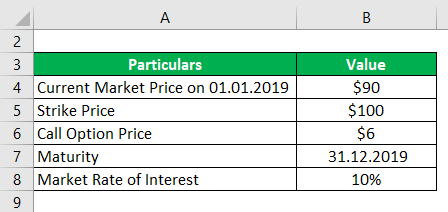

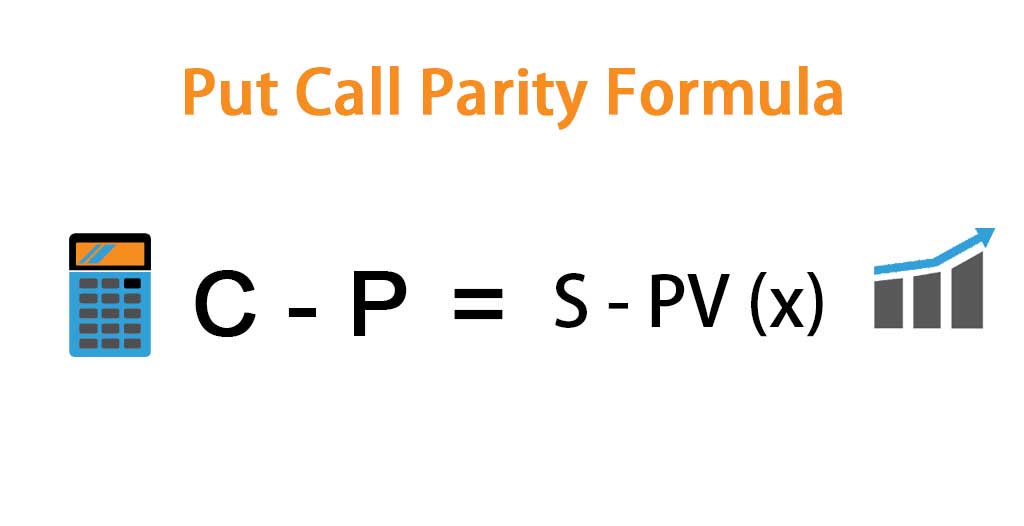

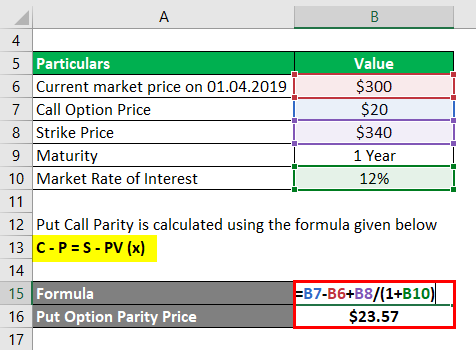

Put Call Parity Formula How To Calculate Put Call Parity

Put Call Parity Formula How To Calculate Put Call Parity

How To Calculate Payoffs To Option Positions Video Lesson Transcript Study Com

Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes

Call Option Understand How Buying Selling Call Options Works

Put Option Meaning Explained Formula What Is It

Put Call Parity Formula How To Calculate Put Call Parity

Calculating Call And Put Option Payoff In Excel Macroption

Put Option Payoff Diagram And Formula Macroption

European Option Definition Examples Pricing Formula With Calculations

Calculating Call And Put Option Payoff In Excel Macroption

Payoff For Call Option Meaning Calculation And Examples

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

Put Call Parity Formula How To Calculate Put Call Parity

Understanding Options Expiration Profit And Loss Cme Group

:max_bytes(150000):strip_icc()/dotdash_Final_Measure_Profit_Potential_With_Options_Risk_Graphs_Mar_2020-01-91faf67825434baba1a46837f4bf1ef3.jpg)

Measure Profit Potential With Options Risk Graphs

Call Option Payoff Diagram Formula And Logic Macroption